COVID-19

Coronavirus Superannuation Measures

Published 6 April 2020

The Australian Government is providing financial assistance to Australians to support them through the coronavirus. Please see below for a list of measures that have been introduced to assist Self-Managed Superannuation Funds.

Temporary early release of superannuation

From mid-April, eligible individuals can apply for a release of up to $10,000 of their super before 1 July 2020. They will also be able to access a further $10,000 from 1 July 2020 until 24 September 2020. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans' Affairs payments.

An individual will be eligible for early release if they satisfy any one or more of the following requirements:

- They are unemployed.

- They are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance.

- On or after 1 January 2020, either

- they were made redundant;

- their working hours were reduced by 20% or more; or

- if they are a sole trader, their business was suspended or there was a reduction in their turnover of 20% or more.

Individuals can apply through myGov from mid-April and certify that they meet the above eligibility criteria. Once the ATO has processed the application, they will issue the individual with a determination, and provide a copy of this determination to the individual's superannuation fund, which will advise them to release the superannuation payment.

Trustee responsibilities for early release of super

Please make sure have received the ATO determination confirming eligibility, prior to releasing any funds from your SMSF.

Temporarily reducing superannuation minimum drawdown rates

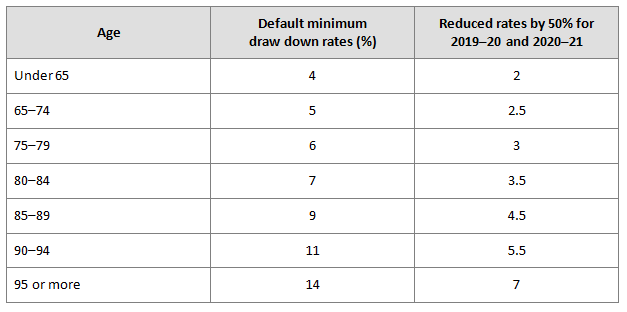

The Government is temporarily reducing the superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for the 2019–20 and 2020–21 income years. This measure will benefit retirees with account-based pensions and similar products by reducing the need to sell investment assets to fund minimum drawdown requirements.

If you have paid the minimum drawdown amount, payments can be stopped for the remainder of the year. If you have paid more than the minimum drawdown amount, you can recontribute these amounts if you are eligible to make superannuation contributions, subject to other rules or limits such as contributions caps.

If you have taken more than the minimum drawdown amount, in some circumstances the additional amount can be treated as a lump sum to reduce your a) Transfer Balance Account or b) accumulation account (where applicable). The main benefit of taking the lump sum is that:

a) a larger amount up to your Transfer Balance Cap could be used to commence an income stream in future years where a contribution is made (e.g. downsizer contribution) or member becomes entitled to a reversionary or death benefit pension; or

b) a higher proportion of the fund will be in pension phase.

There is no change to the maximum pension you can withdraw. For account-based pensions you don't have a limit to the amount you can withdraw from your pension account. For transition to retirement pensions the maximum is set at 10% of the opening account balance on 1 July in the financial year.

Rent relief

If your SMSF has a property and a tenant in financial distress, you may be able to provide your tenant with rental relief under an agreed commercial arrangement. This may even be the case when the tenant is a related party.

Ordinarily, charging a tenant a price that is less than market value in an SMSF is a breach of superannuation laws. However, the ATO have provided guidance which allows SMSF landlords to provide for a reduction in or waiver of rent because of the financial impacts of coronavirus.

For the 2019–20 and 2020–21 financial years, the ATO will not take action where an SMSF gives a tenant – who may also be a related party – a temporary rent reduction or waiver during this period.

Where there are temporary changes to the terms of the lease agreement in response to Coronavirus, it is important that the parties to the agreement document the changes and the reasons for the change. This could be by way of a minute or a renewed lease agreement or other contemporaneous documentation.

In-house asset restrictions

The downturn in the share market may result in the fund's in-house assets being more than 5% of the fund's total assets, which would be a breach of the SIS Act. If, at the end of a financial year, the level of in-house assets of a SMSF exceeds 5% of a fund's total assets, the trustees must prepare a written plan to reduce the market ratio of in-house assets to 5% or below. This plan must be prepared before the end of the next following year of income. If an SMSF exceeds the 5% in-house asset threshold as at 30 June 2020, a plan must be prepared and implemented on or before 30 June 2021. However, the ATO will not undertake compliance activity if the rectification plan was unable to be executed because the market has not recovered or it was unnecessary to implement the plan as the market had recovered.

Investment strategies

The downturn in the market may impact on your SMSF's investment strategy. Trustees must prepare and implement an investment strategy for their SMSF, which they must then give effect to and review regularly. The strategy should be reviewed at least annually, and you should document that you've undertaken this review and any decisions arising from the review. Certain significant events, such as a market correction, should also prompt a review of your strategy and may require updating your investment strategy.

Where the assets of an SMSF or the level of investment in those assets fall outside of the scope of your investment strategy, you should take action to address that situation, which could involve adjustments to investments or updating your investment strategy. All investment decisions must be made in accordance with the investment strategy of the fund. If in doubt, trustees should seek investment advice.

Reduced social security deeming rates

As of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. The reductions reflect the low interest rate environment and its impact on the income from savings. The change will benefit around 900,000 income support recipients, including around 565,000 people on the Age Pension who will, on average, receive around $324 more from the Age Pension in the first full year that the reduced rates apply.

Resources

More information on the above measures can be found via the following links.

Treasury Fact Sheet:

- Early access to superannuation: https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Early_Access_to_Super_2.pdf

- Providing support for retirees: https://treasury.gov.au/sites/default/files/2020-03/factsheet6providingsupportforretireestomanagemarketvolatility-25march2.pdf

Australian Taxation Office:

- https://www.ato.gov.au/Super/Sup/Government-s-COVID-19-economic-response-assists-SMSFs-and-their-members/

- https://www.ato.gov.au/General/COVID-19/In-detail/COVID-19-frequently-asked-questions/?page=8

We will be sending further information as it comes to light. Please contact us with any urgent queries.

Related Pages

Contact & Connect

For more information on how our expertise can benefit you, contact us today.